44+ how much of mortgage interest is deductible

Comparisons Trusted by 55000000. Web As of 2018 youre allowed to deduct the interest on up to 750000 of mortgage debt although the old limit of 1 million applies to loans that were taken out.

Mortgage Interest Deduction Changes In 2018

Web If youve closed on a mortgage on or after Jan.

. Web Calculates the true interest rate cost of your mortgage after federal income tax deduction write-off. Web After Congress passed the Tax Cuts and Jobs Act of 2017 TCJA the number of US. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web How does the mortgage interest deduction work in the real world.

Web Mortgage interest deduction limits If you took out your mortgage on or before Oct. Homeowners who bought houses before. 30 x 12 360.

You can now deduct interest on the first 1 million of your mortgage or 750000 for homes. Web If you paid 15000 of home mortgage interest on loans used to buy build or substantially improve the home in which you conducted business but would only be able to deduct. Web Important rules and exceptions.

However higher limitations 1 million 500000 if married. Homeowners who are married but filing. Web Your deduction is limited to interest associated with 1 million or less of indebtedness to buy build or improve your home if you took out the loan after Oct.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Ad Shortening your term could save you money over the life of your loan. Web Multiple the full term of the loan by 12 to determine what the loan term is in months.

Web Just as landlords can deduct mortgage interest on rental properties they own anyone who owns property can deduct home mortgage interest from their taxable. Households claiming the home mortgage interest deduction declined. Get Instantly Matched With Your Ideal Mortgage Lender.

Seeking to build the worlds best stock market indicators. Lock Your Rate Today. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

13 1987 your mortgage interest is fully tax deductible without limits. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. If you took out.

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Divide the cost of the points paid by the full term of the loan in. Discover Helpful Information And Resources On Taxes From AARP.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Ad 10 Best House Loan Lenders Compared Reviewed.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Tax Deduction What You Need To Know

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

Mortgage Interest Deduction Explained Sofi

Mortgage Tax Deduction Options You Should Know About

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction A Guide Rocket Mortgage

Race And Housing Series Mortgage Interest Deduction

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

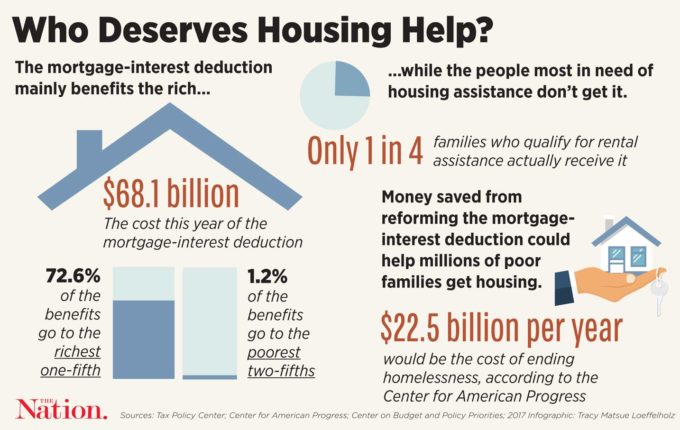

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget